Giving to charity is an admirable act and one that should be taught even to small children. Some kids exposed to charitable giving at an early age find it worthwhile to donate part of the monetary gifts they receive when they reach the age of 16 or 18. Some adults, however, start out in this endeavor at a later age.

There’s no age limit to the act of giving to charities and regardless of when you start donating, what matters is you are sincere in what you do. It’s a different kind of personal fulfillment if one is able to share his or her blessings, particularly hard-earned money.

But the question is, “Do you need to ask for an official receipt every time you donate money to a non-profit charitable organization?”

Ideally, a charity should issue receipts to donors. It is a legal obligation of a non-profit group to do so. Also, people who have donated money will need official receipts in order to make a claim on their annual income tax returns.

Penalties are imposed for organizations that fail to provide the correct and complete information in their receipts. A higher penalty will be charged for those that issue an official receipt but with deliberately false information.

These receipts can be issued by registered charities periodically or after each donation throughout the year. For cash donations, however, a single cumulative receipt may be issued at the end of each year. Additionally, a charity may choose to issue a separate receipt for donations in kind or the non-cash donations.

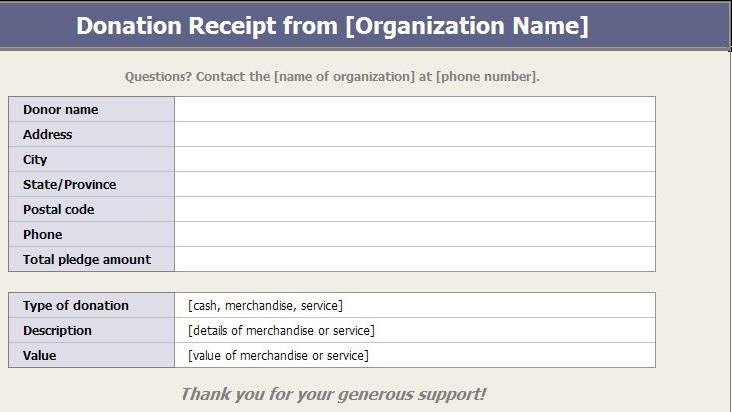

Details in the Receipt

At the close of each year, charities may have to issue statements or receipts to their donors.

A yearend statement is normally a simple letter providing details of what a person or group contributed for that year. It is also one way of thanking them for their untiring support. It should enumerate all the donations and give a total amount for the contributions. The organization’s head or an officer should sign the letter.

Alternatively, a yearend receipt can be issued but this is more detailed and complicated than the yearend statement. This must contain certain information required by the Internal Revenue Service (IRS). These include the organization’s name, amount of cash donation, description for non-cash donation, statement that no goods or services were provided in exchange for the donation, description or estimated value of goods or services provided in exchange for the donation or a statement that goods or services were provided in return for the donation but covered only intangible religious benefits.

In cases when these charitable organizations no longer receive the usual financial support they used to enjoy, they are protected from being forced into bankruptcy in accordance to Section 303 of the U.S. Bankruptcy Code. It’s either they dissolve or settle things with their creditors.

In the event the non-profit organization files for bankruptcy, its assets are then liquidated. If the decision is voluntary dissolution, the organization’s endowment will have to be distributed to another group with the same program.

Charities in the L.A. California area can consult at Los Angeles Bankruptcy attorney regarding this to ensure that they know the procedures when filing for bankruptcy or dissolution should things go wrong in the future. It’s always best to be prepared for any eventuality.

Originally posted on August 20, 2014 @ 9:52 am